Understanding Pips in Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies to make a profit. The forex market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. One of the fundamental concepts every trader must understand is the “pip.” The term “pip” stands for “percentage in point” or “price interest point.” It represents the smallest price movement in the exchange rate of a currency pair. Grasping the concept of pips is crucial for forex traders as it helps in calculating profits and losses, managing risk, and developing effective trading strategies.

What is a Pip?

A pip, or “percentage in point,” is the smallest unit of measurement in forex trading, typically equating to 0.0001 for most currency pairs. For instance, a movement from 1.1050 to 1.1051 in the EUR/USD currency pair represents a one-pip change. For currency pairs involving the Japanese yen (JPY), a pip is equal to 0.01 due to the different decimal structure. Additionally, there are pipettes, which are one-tenth of a pip (0.00001). Understanding pips and pipettes is crucial for traders to measure and interpret price movements accurately.

Examples:

- EUR/USD:

- One pip = 0.0001

- Movement from 1.1050 to 1.1051 = 1 pip

- USD/JPY:

- One pip = 0.01

- Movement from 110.50 to 110.51 = 1 pip

- GBP/USD:

- One pip = 0.0001

- Movement from 1.3000 to 1.3001 = 1 pip

Fractional Pips (Pipettes)

Fractional pips, also known as pipettes, represent one-tenth of a standard pip. They provide more precise measurements and are used by some brokers to offer finer pricing details. For most currency pairs, a pipette equals 0.00001. This allows traders to see price movements with greater granularity, improving the precision of their entries and exits.

Examples:

- EUR/USD:

- One pipette = 0.00001

- Movement from 1.10500 to 1.10501 = 1 pipette

- USD/JPY:

- One pipette = 0.001

- Movement from 110.500 to 110.501 = 1 pipette

Pips in Index Values:

In indices trading, movements are measured in points rather than pips. For example:

- Dow Jones Industrial Average (DJIA):

- Movement from 34,000 to 34,010 = 10 points

- If trading one standard contract where each point is worth $1, a 10-point move equals $10.

- NASDAQ-100:

- Movement from 15,000 to 15,010 = 10 points

- If trading one standard contract where each point is worth $20, a 10-point move equals $200.

Understanding these measurements helps traders in forex and indices markets to accurately gauge and respond to price movements.

Significance of Pips in Trading

Pips are fundamental in forex trading because they quantify price changes in a standardized way, allowing traders to compare different currency pairs and make informed decisions. The movement of pips directly impacts a trader’s potential profit or loss. For example, if a trader buys the EUR/USD pair at 1.1050 and sells it at 1.1060, they have made a profit of 10 pips. Conversely, if the price drops to 1.1040, the trader incurs a 10-pip loss. This standardized measurement helps traders set stop-loss and take-profit levels, manage their risk, and develop trading strategies based on historical price movements.

Calculating the Value of a Pip

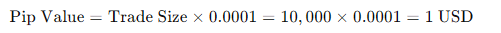

The value of a pip varies depending on the currency pair being traded, the size of the trade, and the exchange rate. For currency pairs where the USD is the quote currency, such as EUR/USD, the pip value is fixed at $0.0001. For example, if a trader buys 10,000 units of EUR/USD, the pip value is calculated as follows:

For currency pairs where the USD is the base currency, such as USD/CAD, the pip value depends on the exchange rate. If a trader buys 100,000 units of USD/CAD at an exchange rate of 1.2829, the pip value is calculated as:

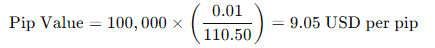

For currency pairs involving the Japanese yen, such as USD/JPY, the pip value is calculated by dividing by 100 instead of 10,000.

Example Calculations

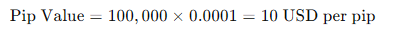

Consider a trader who buys 100,000 units of EUR/USD at 1.1050. If the price rises to 1.1070, the trader gains 20 pips. The pip value for this trade is:

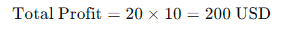

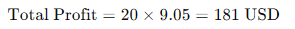

Thus, the total profit is:

Conversely, if the price drops to 1.1030, the trader loses 20 pips, resulting in a $200 loss. For a trade involving USD/JPY, if a trader buys 100,000 units at 110.50 and the price moves to 110.70, the gain is:

The profit for a 20-pip move is:

Impact of Pips on Trading Strategies

Pips play a critical role in shaping trading strategies. Traders use pips to set stop-loss and take-profit levels, ensuring that they exit trades at predetermined points to manage risk and secure profits. For example, a trader might set a stop-loss 20 pips below the entry price to limit potential losses. Similarly, a take-profit order might be placed 50 pips above the entry price to lock in gains. Understanding pip values also helps traders assess the risk-reward ratio of a trade, a key factor in successful trading. By analyzing historical pip movements, traders can identify trends and develop strategies to capitalize on market opportunities.

Real-World Application

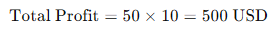

Let’s consider a scenario where a trader buys 100,000 units of EUR/USD at 1.1050 and sets a take-profit order at 1.1100 and a stop-loss at 1.1025. If the price reaches the take-profit level, the trader gains 50 pips, resulting in a profit of:

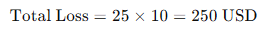

If the price hits the stop-loss level, the trader loses 25 pips, resulting in a loss of:

By setting these levels, the trader can manage risk effectively while aiming for a higher profit potential. Understanding how pips translate to actual currency value allows traders to make informed decisions and develop robust trading plans.

Conclusion

In conclusion, pips are a foundational concept in forex trading, providing a standardized unit of measurement for price movements. Accurate knowledge of pip values and their impact on trades is essential for effective trading strategies and risk management. By understanding how to calculate and apply pips, traders can better navigate the forex market, making informed decisions to optimize their trading outcomes. Whether you are a novice or an experienced trader, mastering the concept of pips is crucial for success in the dynamic world of forex trading.